Social Media Trends in the QSR Industry in India

The competition is fierce in the QSR industry in India. Burgers, pizzas, sandwiches and coffee compete alongside existing fast food restaurants serving local items at prices that are often far cheaper. In order to stand out from the crowd, QSR brands need to come up with innovative menu items and position themselves as a good alternative to local food options.

In this report, we looked at the performance of fifteen QSR brands in India on Facebook, Twitter and Instagram between 2013 and 2016. The brands included in this report are:

All data and charts sourced from: Unmetric Social Media Intelligence Platform

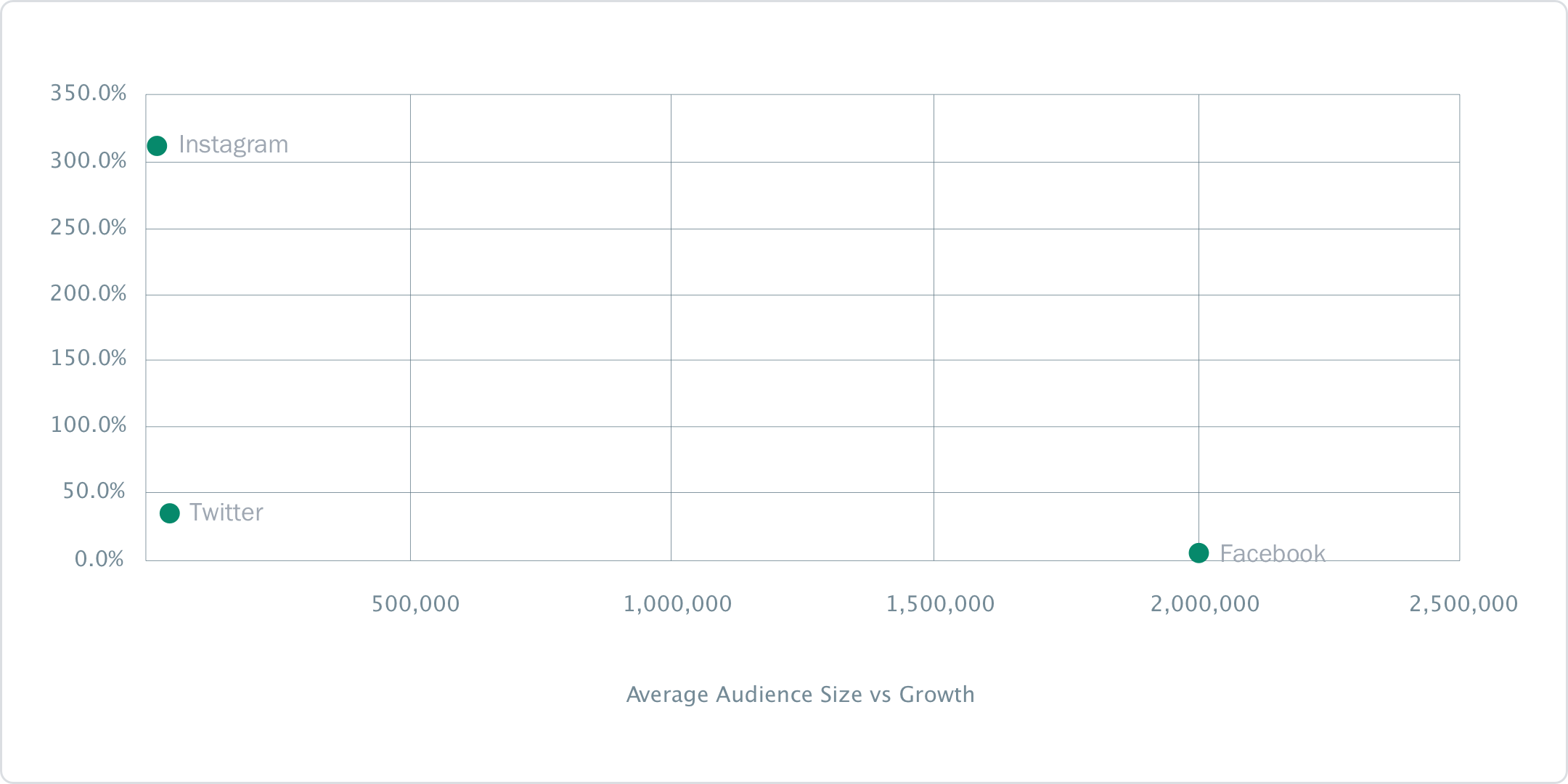

QSR Audience Growth & Size by Channel

Facebook dominates the conversation when it comes to talking about the presence of QSR brands on social media. However, 2016 saw Instagram burst onto the scene and register triple figure growth rates. It still has a long way to go before it becomes as popular as Facebook, or even Twitter, but given the easy engagement and unique demographic, Instagram should not be entirely ignored. That said, Facebook is the only significant social network for QSR brands in India right now.

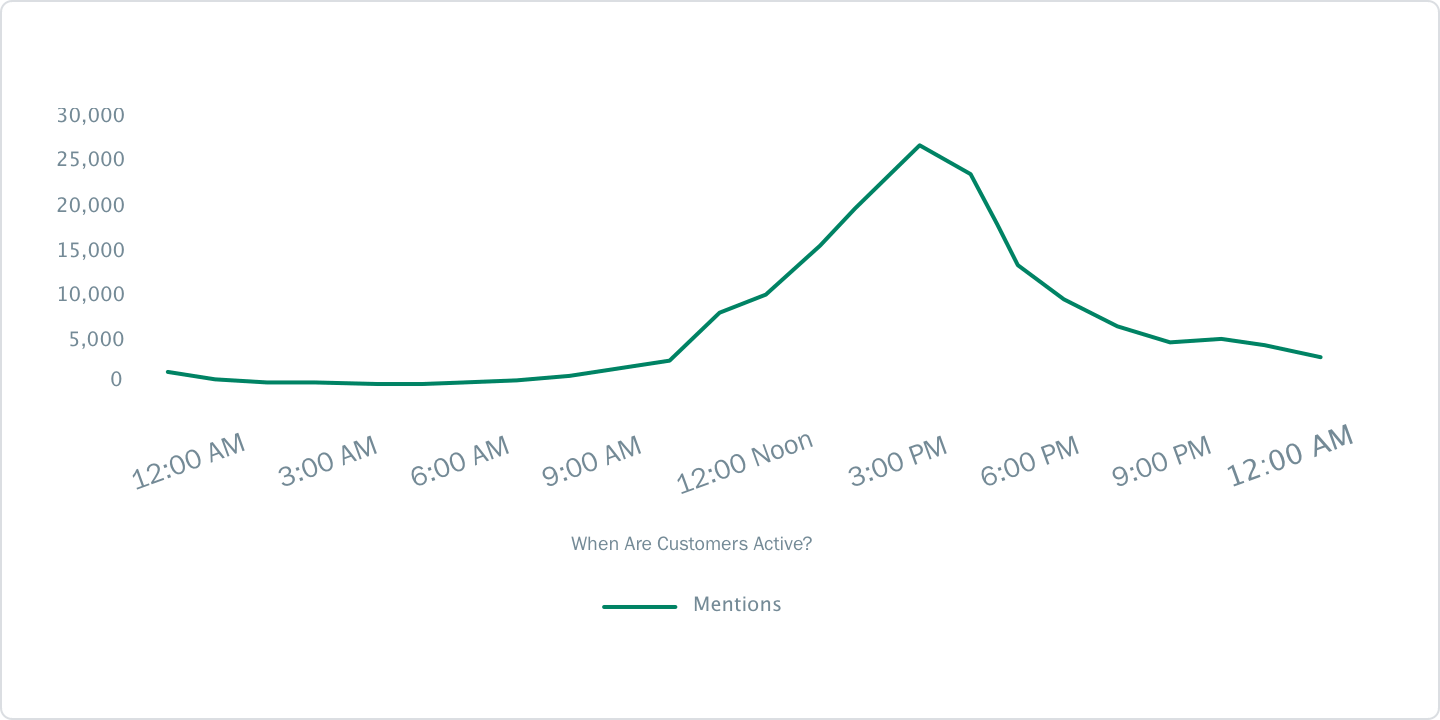

When is the Audience for QSR Brands Online?

A key part of any social media strategy is to publish content when your audience is online. Although promoted posts have changed the nature of this concept somewhat (it probably doesn’t matter when you boost your post but by how much money you put behind it and your targeting options), it’s still important to know when your audience is online. We looked at the distribution of Twitter mentions to determine when people are likely to be talking about your brands. For 12 hours between 10pm and 10am IST, the conversation is almost non-existent. After 10am the conversation rises until it peaks at 3pm. Most of the conversation around QSR brands on Twitter happens in the late afternoon (3pm – 6pm) which suggests that it’s a good time for publishing content.

What are QSR Brands Talking About?

Using Unmetric Discover, a searchable database of over 500,000,000 pieces of content that is automatically sorted into semantically linked topics, we uncovered the following topics and conversation opportunities for QSR brands in India.

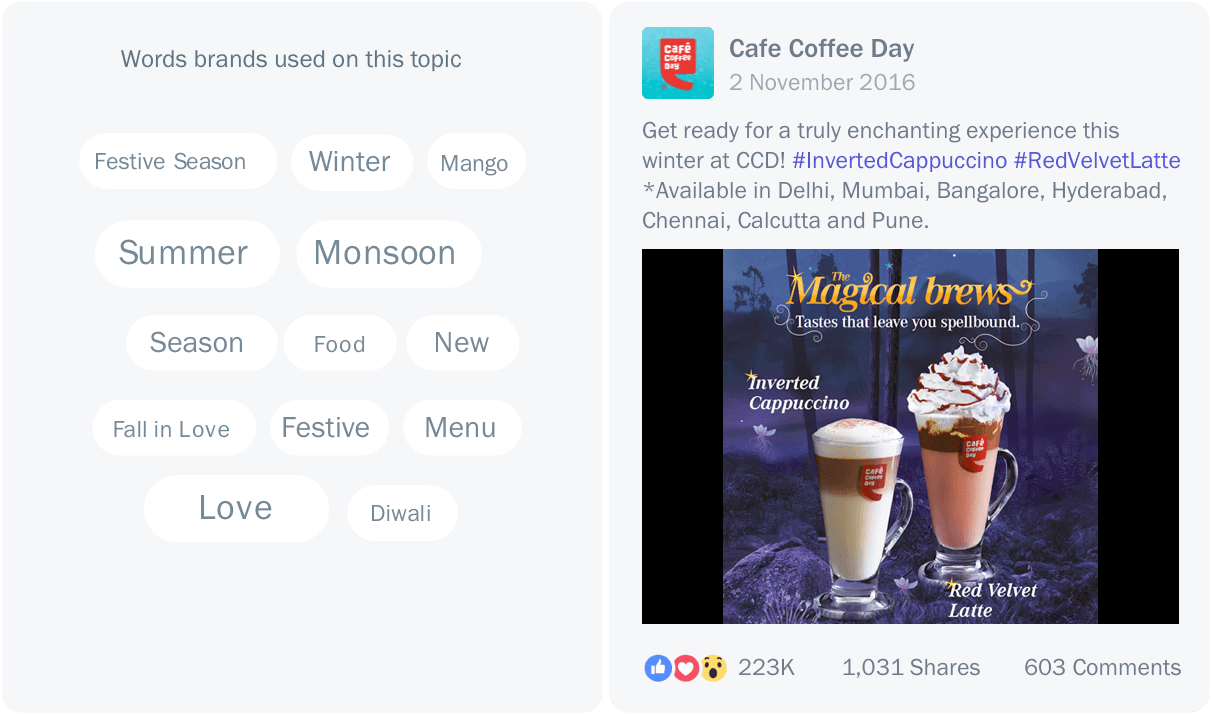

SEASONS

29,500 posts

The promoted post by Cafe Coffee Day was one of the most engaging posts around the topic of seasons. Many brands published a lot of content around ‘festive’ seasons, but far fewer were likely to talk about the monsoon, winter and summer.

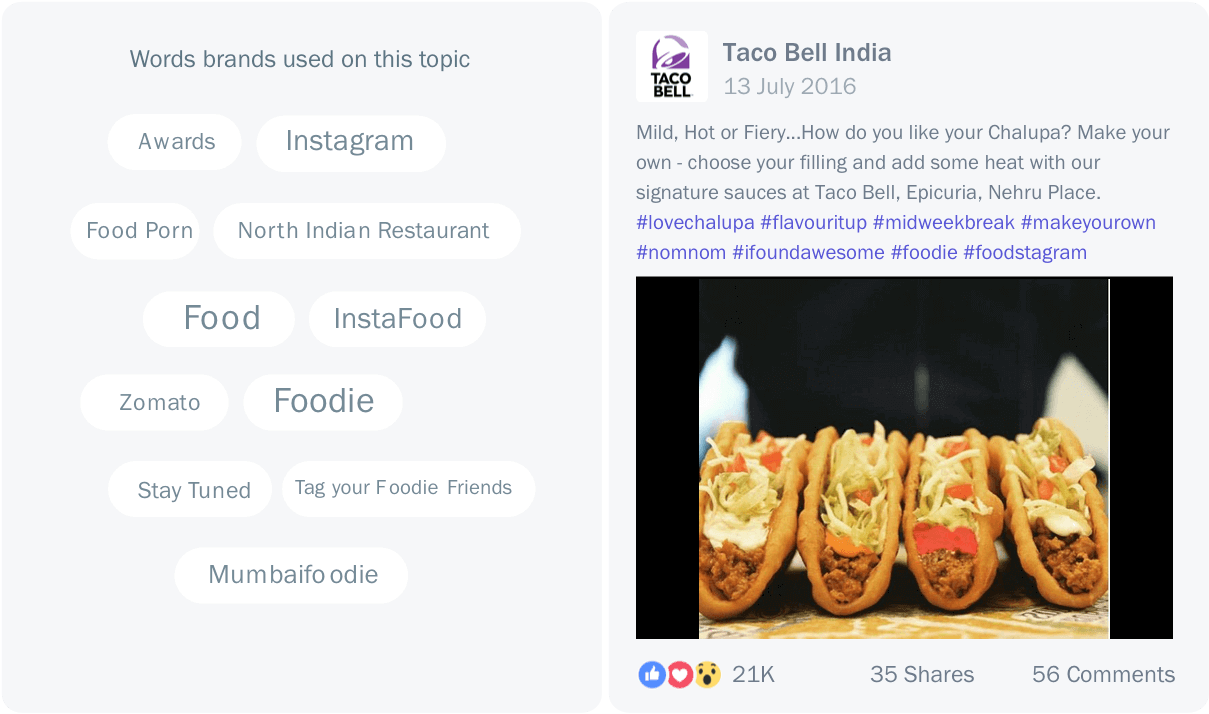

FOODIE

10,200 posts

Food porn is a real thing and people can’t get enough of it. Zomato has brought out the foodie in everyone and Instagram is full of people snapping their food. QSR brands could be leveraging these hashtags a lot more like Taco Bell did in this promoted post.

Some brands dominated conversations by latching on to topics that didn’t quite occur to other brands. Using Discover we spotted these conversations and the great engagement they generated.

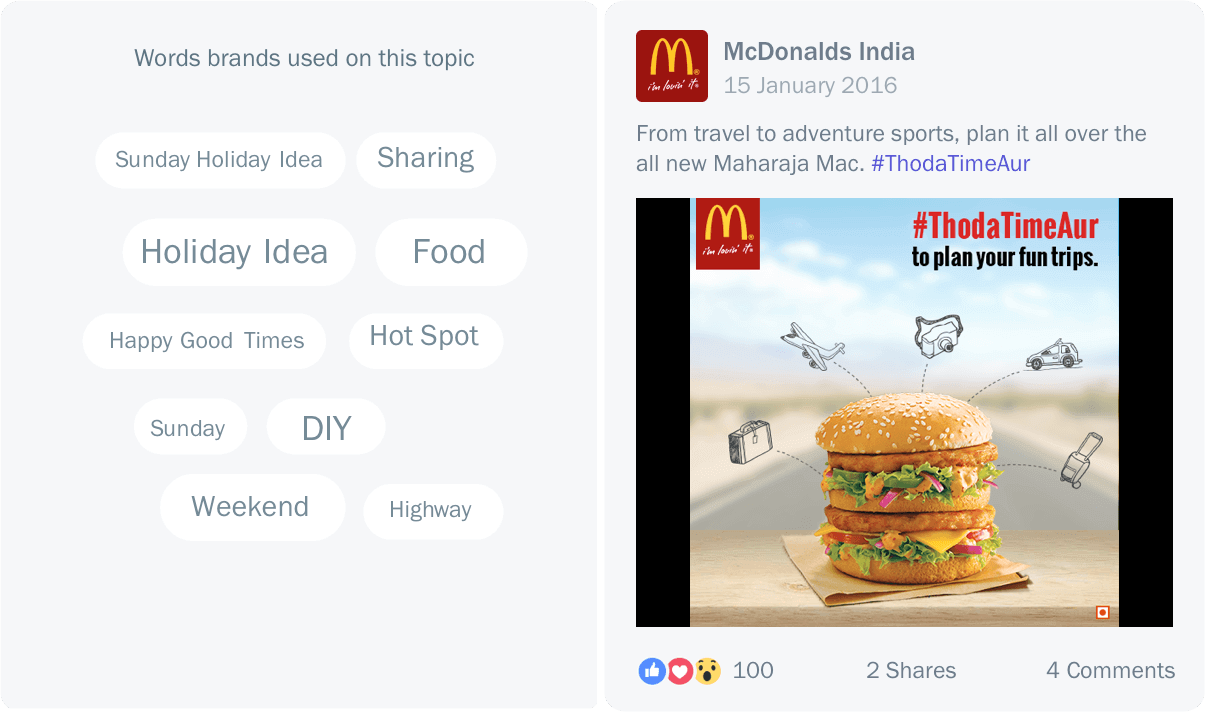

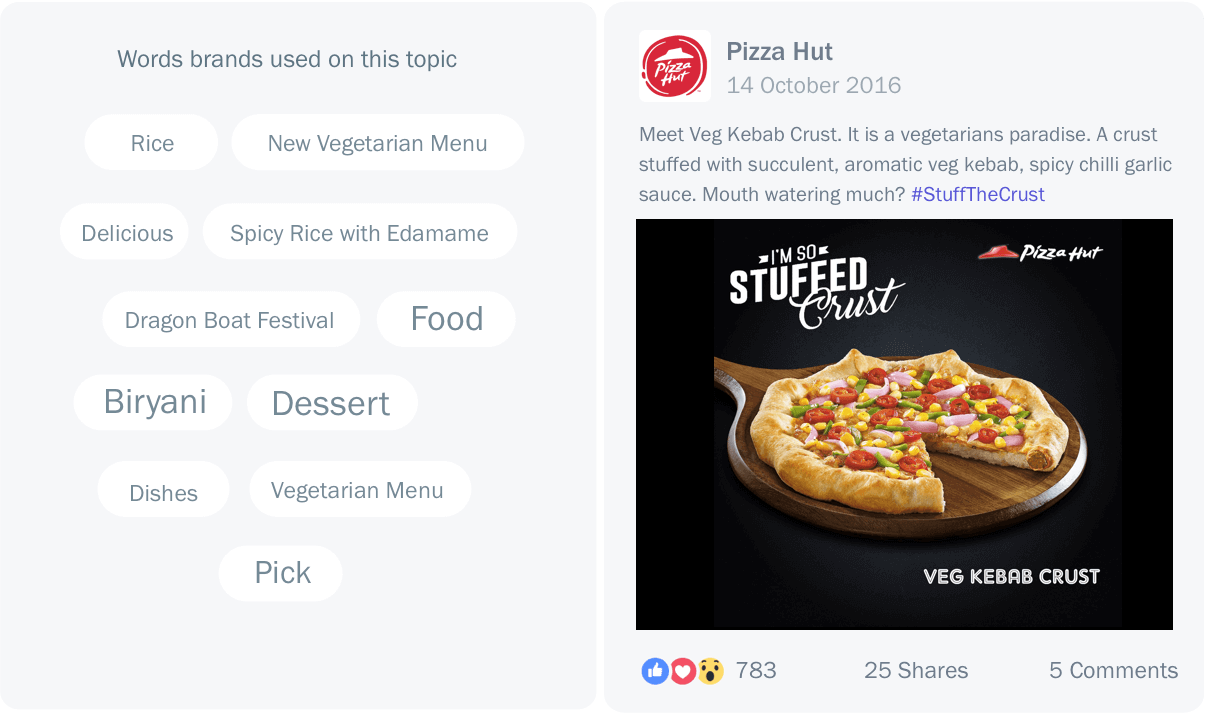

TRAVEL & WEEKEND

2,700 posts

Travel and holidays might not seem like a natural fit for QSR brands, but many are leveraging this topic for their content and seeing good engagement as a result. McDonald’s organic post ties together the insight that people meet up for food to discuss their holiday or travel plans.

VEGAN & VEGETARIAN

2,500 posts

India is a nation of vegetarians which QSR brands should ignore at their peril. There’s a big opportunity for brands to promote their vegetarian, vegan or Jain menu items as Pizza Hut has shown in this very well received promoted post on Facebook.

Trends

What’s Happening in the QSR Industry on Social Media

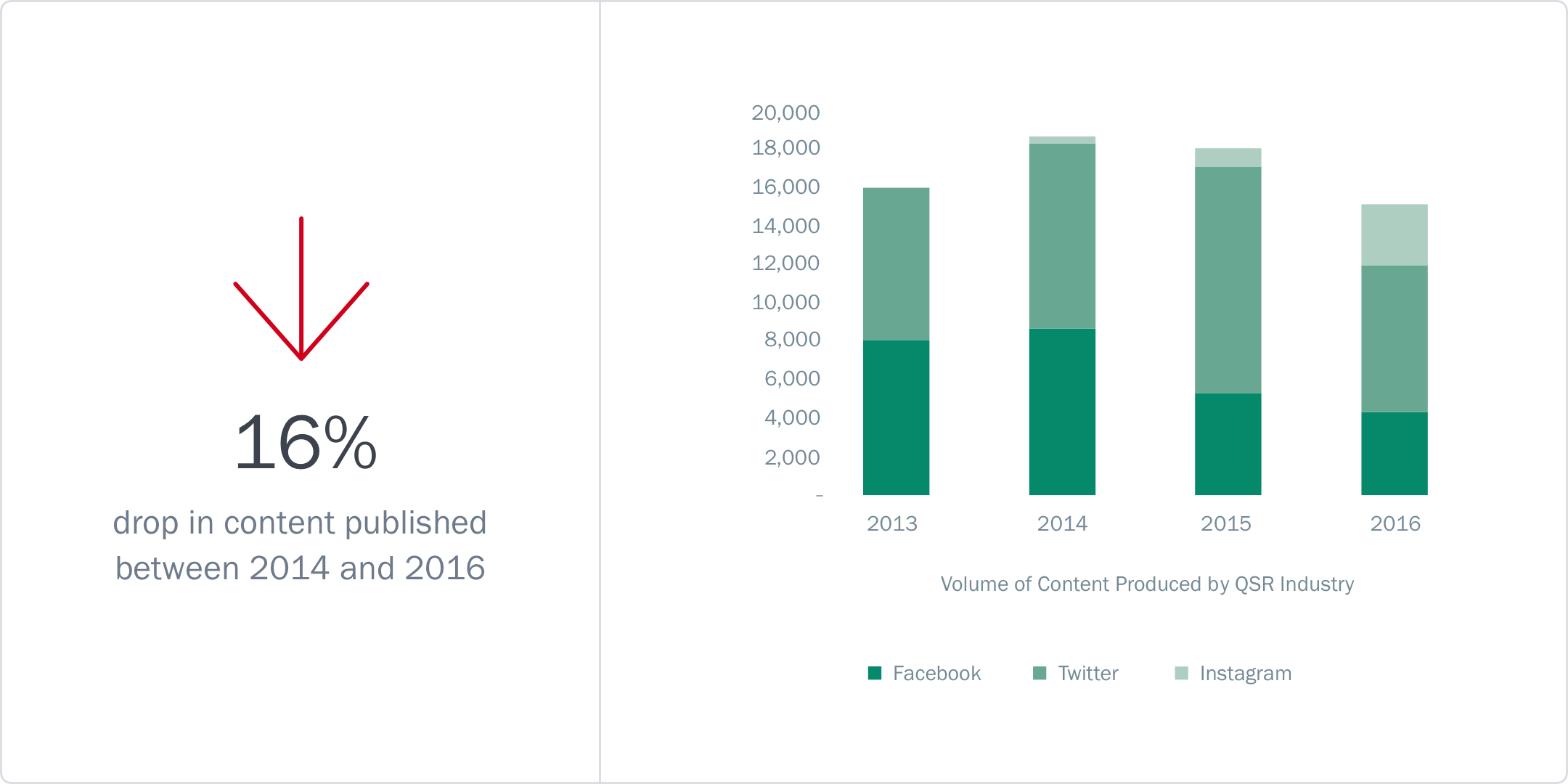

1. Total Content Published by QSR Brands is Falling

It might be hard to believe, but our analysis shows that the total amount of content published by QSR brands has been decreasing since 2014. Facebook has registered a 46% drop in content published in 2016 compared to 2013. Only Instagram has registered an increase in content, with more than eight times the amount of content published in 2016 compared to 2014. However, the increase in content published on Instagram wasn’t enough to offset the fall in content published on Facebook and Twitter.

- The amount of content published by KFC on its Facebook Page dropped by 87% between 2013 and 2016

- Domino’s published almost 3 posts per day on Instagram which is three times more than what the average QSR brand published in 2016

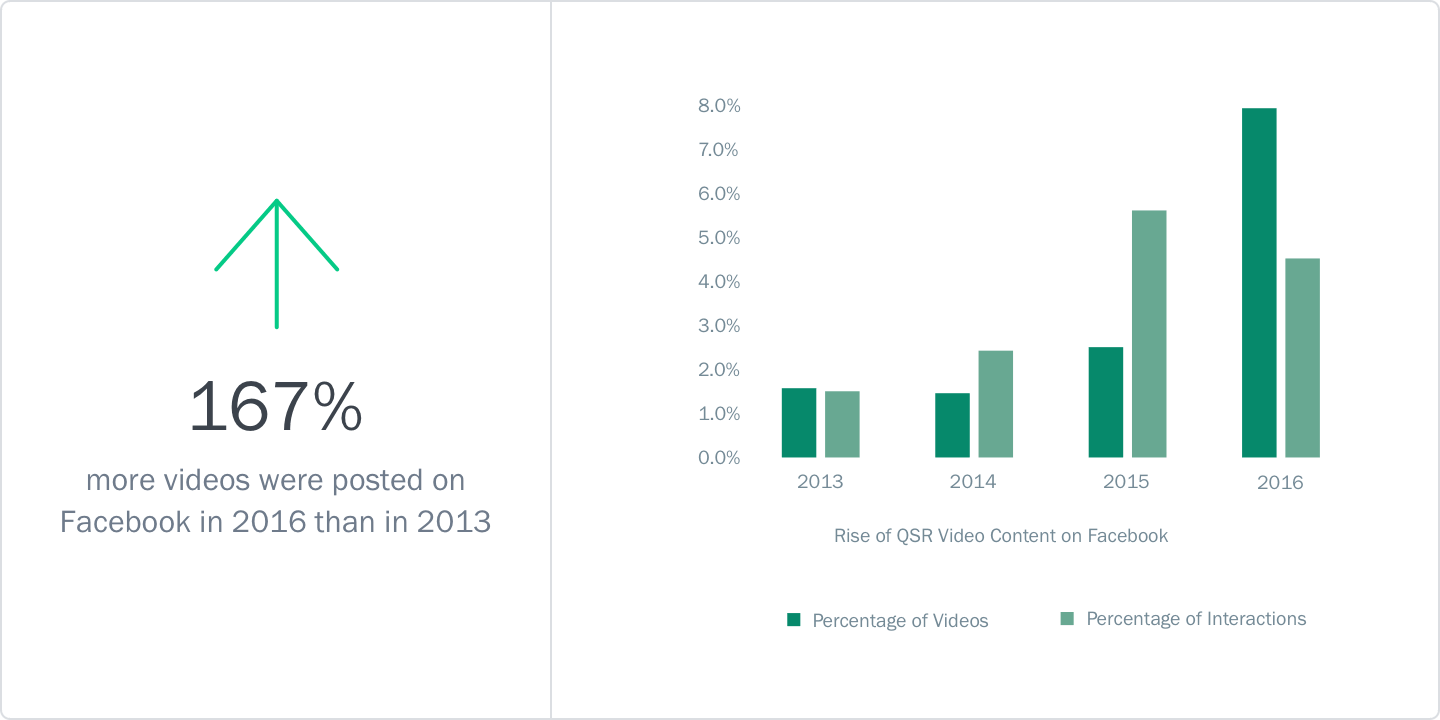

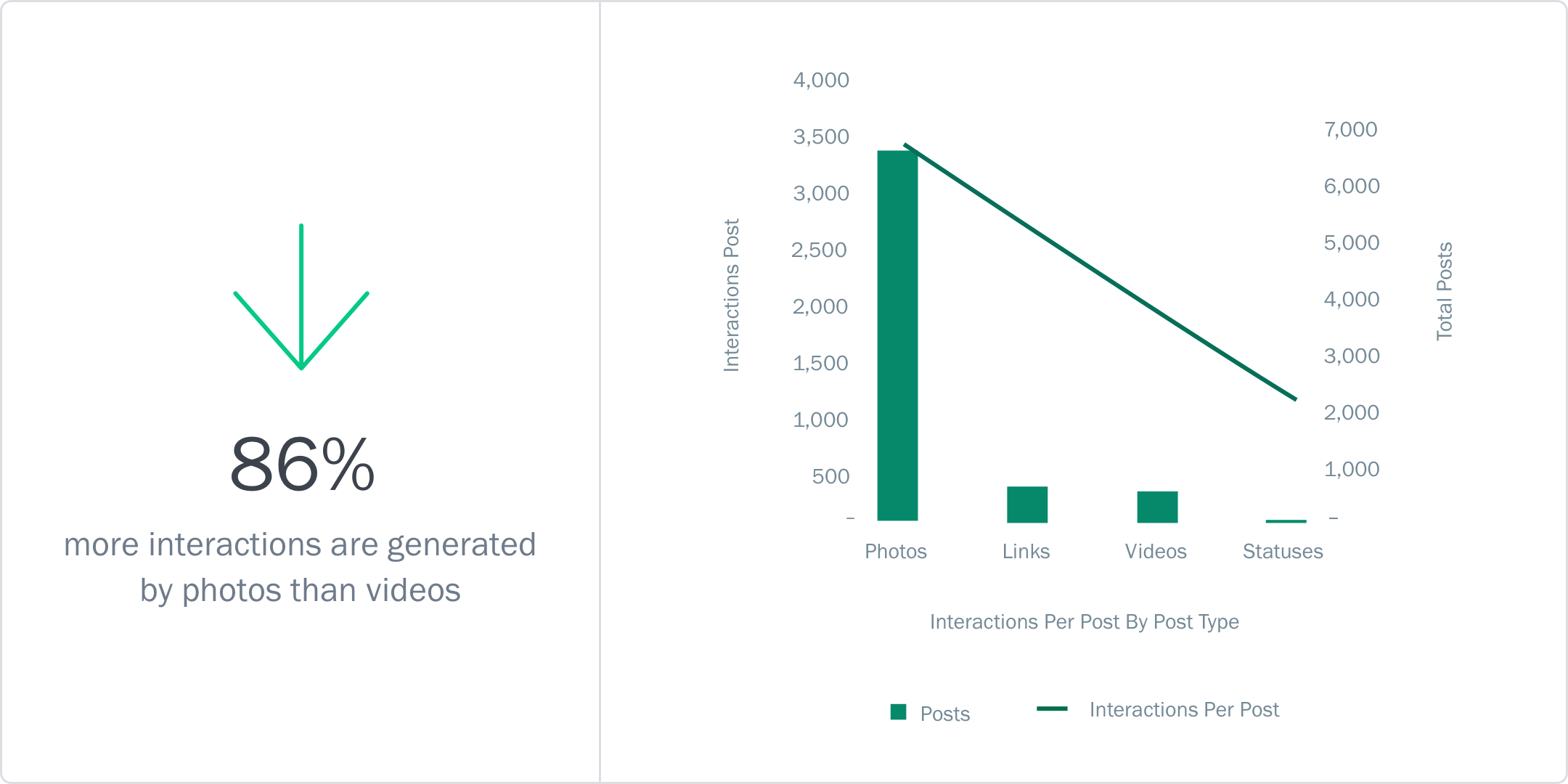

2. Video Grows in Importance but Brands Still Prefer Photo Content

Across industries, brands are publishing more videos than ever. The Indian QSR industry is no different, with 320 videos published in 2016 compared to 120 in 2013. However videos only made up 7.6% of all content that brands published with photos remaining by far the most popular type of content. Perhaps one reason for this is that videos are not producing the expected engagement returns for the industry. Our analysis found that although videos made up 7.6% of the total content published, they only generated 4.3% of the total user interactions.

- Domino’s published more than four videos on its Facebook Page each month, which is double the average amount of videos published by QSR brands

- KFC published the highest percentage of videos on its Facebook Page. Out of 121 posts in 2016, 32% were videos

3. Photos Drive the Most Interactions on Facebook

Our studies in the past found that videos were the most engaging type of content on a Facebook Page. To our surprise, our recent analysis of the QSR industry in India found the exact opposite – videos were not the most engaging type of content. Brands in the Indian QSR industy are relying almost exclusively on photos which make up more than 82% of the total content and also contribute the most to the total engagement the pages generate. However, a deeper analysis shows that people are far more likely to share a video than a photo. Videos generate 676% more shares per post than photos, potentially generating a wider reach. 98.5% of the total interactions on a video comes from likes.

- Cafe Coffee Day published the most shared piece of QSR content in 2016 – a video with over 7,350 shares which formed part of its #MagicalBrews campaign

- Costa Coffee published three times more photos than the average QSR brand in India in 2016 and that accounted for 97.5% of the total interactions generated on all its content

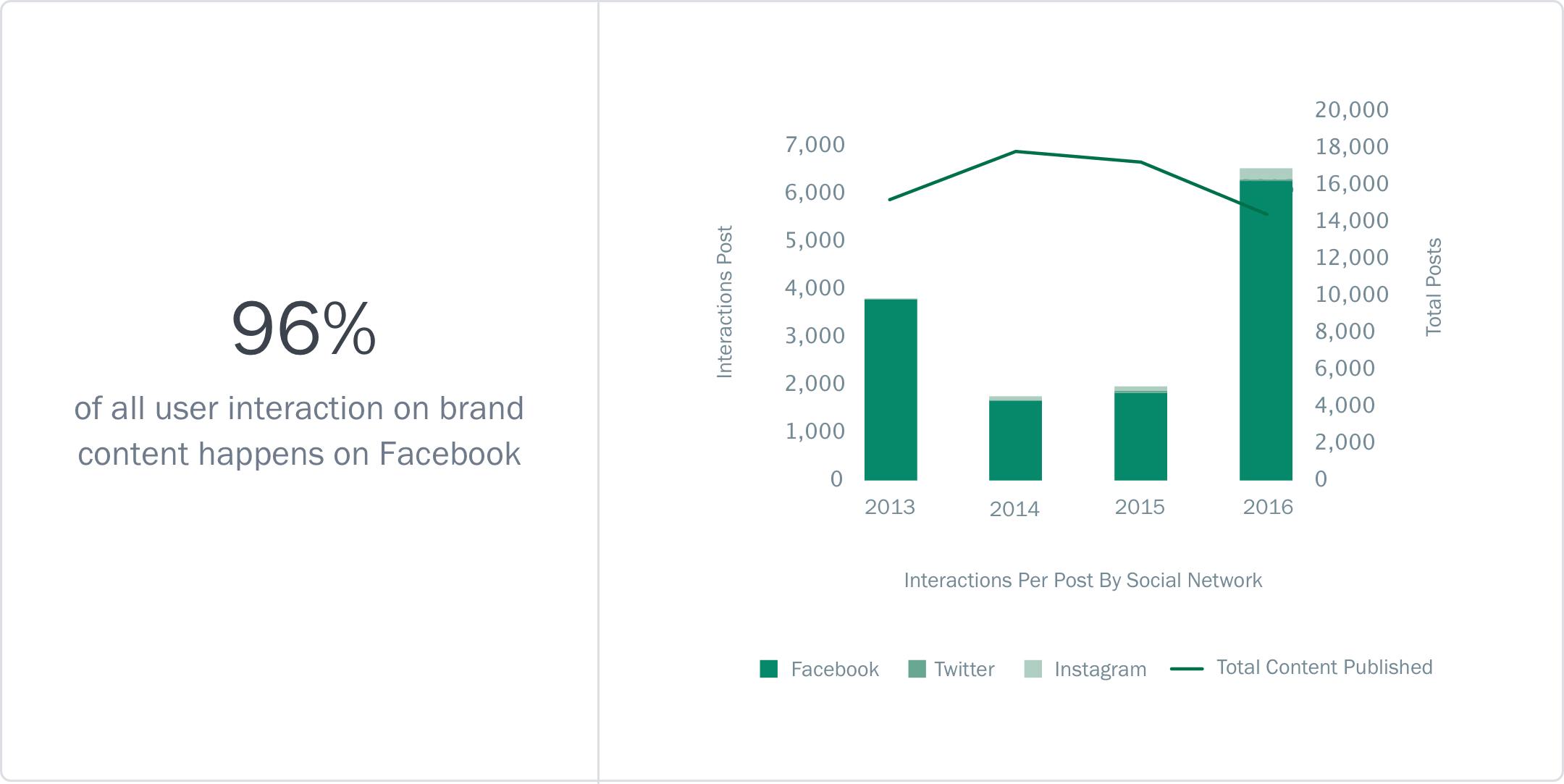

4. Facebook is the Largest Driver of Engagement for QSR Brands

The importance of Facebook as a place for brands to build visibility cannot be overstated enough. Although many brands are seeing relative success on platforms like Instagram, for the QSR industry in India, Instagram remains a distant second when it comes to interactions per post. In part, this is likely because QSR brands have a much smaller presence on Instagram (an average audience size of 21,000 versus 2,000,000 on Facebook). The declining interactions per post on Facebook due to reduced organic reach has reversed in 2016 as we found many more brands were willing to promote their posts in order to drive engagement. This resulted in more than three times the engagement in 2016 compared to 2015.

- With 28,500 interactions per post on Facebook, KFC generated nearly five times more interactions than the average QSR brand in 2016

- The Coffee Bean & Tea Leaf and Costa Coffee generated 19 and 32 interactions per post respectively. Cafe Coffee Day generated over 19,500 interactions per post, 780 times more than the aforementioned coffee shops

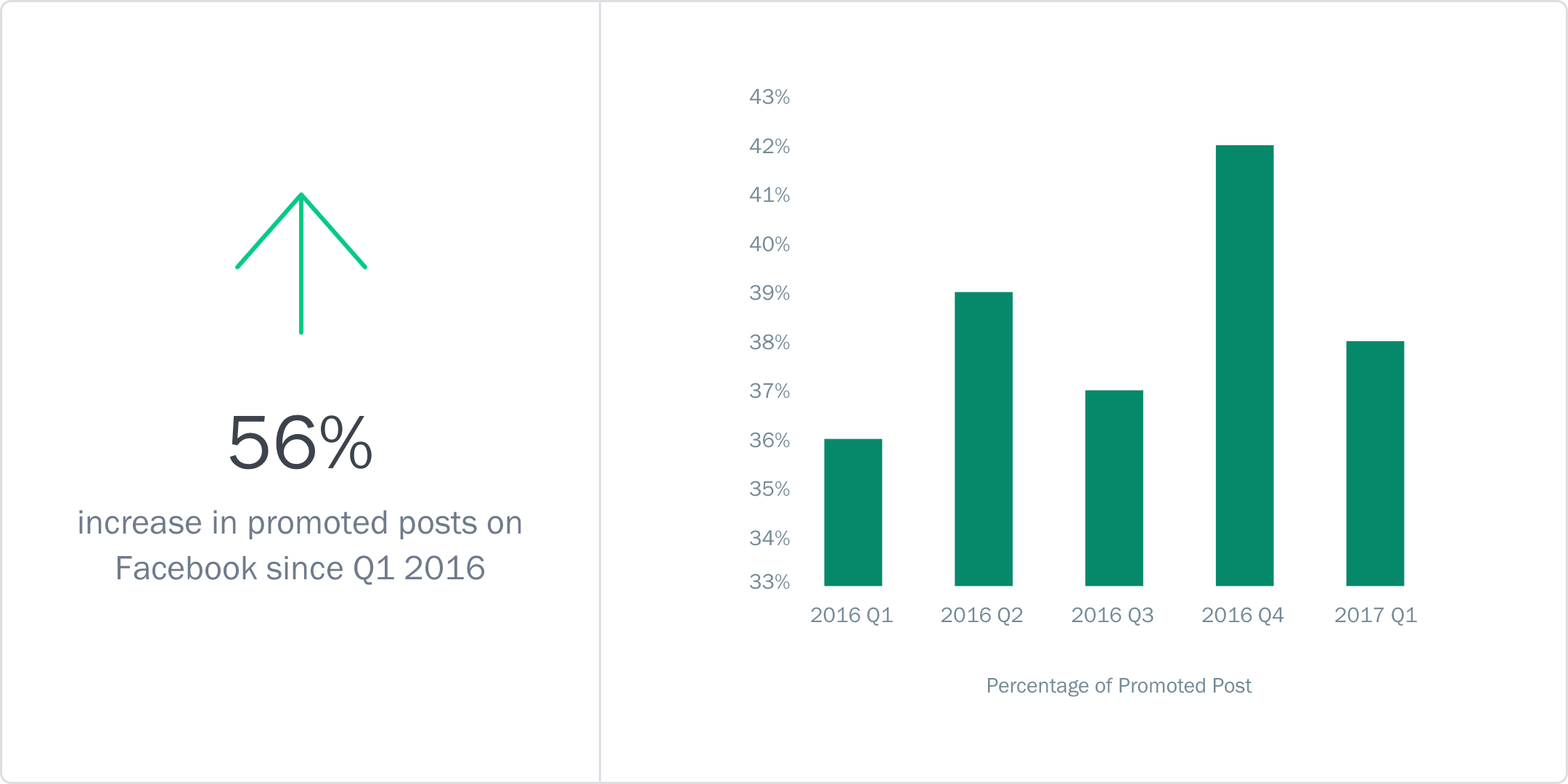

5. QSR Brands Promoting More Content on Facebook

Organic Reach on Facebook is at an all time low – for every interaction generated by a non-promoted post, a promoted post generates 13.5 interactions. Brands were most likely to promote a link on Facebook which generates 600% more engagement compared to a non-promoted link. When a QSR brand promoted a photo – which was just 4% of the time in 2016 – it generated more than 700% engagement compared to a non-promoted photo. Videos saw one of the lowest increases in engagement when they were promoted, just 200%. There are still many QSR brands that promote less than 5% of their content on Facebook and their engagement is just a fraction of the industry average.

- KFC promoted 70% of its content in 2016, which is very likely the reason why it saw far more interactions per post than any other brand

- Subway only promoted 11% of its content but when it did, it generated over 190 times more interactions over its non-promoted content

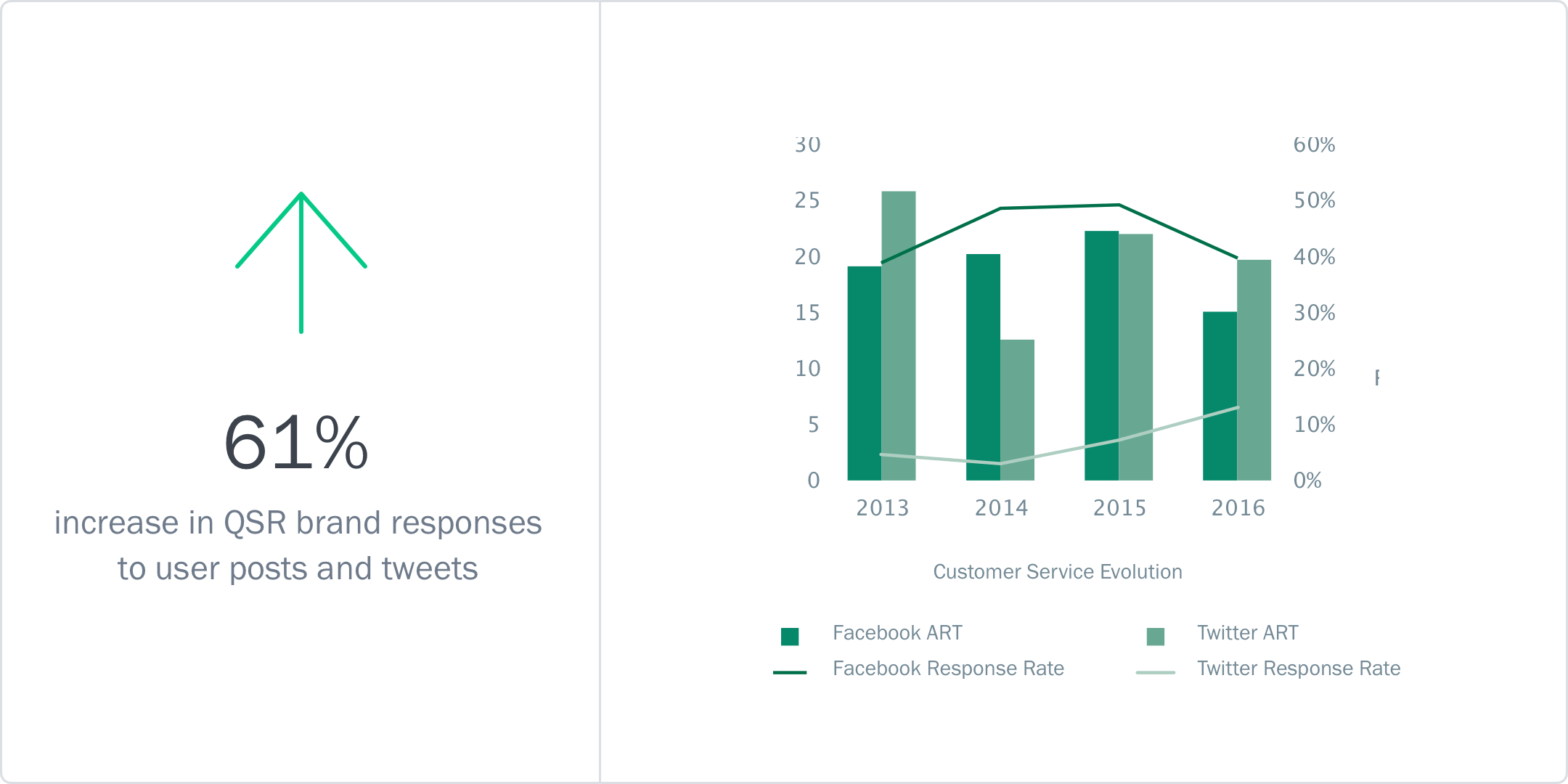

6. QSR Brands Still Take Nearly One Day to Respond to Customers

Customer service is a critical part of any QSR operations. Fail to provide flawless, efficient service, and you can be sure that it is broadcast all over social media in no time. In India, most QSR brands have realised that the key to customer satisfaction is to resolve questions and complaints as efficiently as possible. Between 2013 and 2016, brands have increased the number of questions they reply to and have reduced the average amount of time to reply to those questions by several hours. However, with response rates of 40% and 13% on Facebook and Twitter respectively, and average reply times that run into the following day, there is still a huge improvement to be made in this area of business.

- Pizza Hut is the most responsive QSR brand in India on Facebook, replying to 50% of user posts in 2016 in an average of 15 hours

- Domino’s replied to more tweets in 2016 than all the other QSR brands in India combined, and they did so faster than most other brands with an average reply time of 14.5 hours